As cities grow and the need for more housing increases, multifamily projects are becoming a big deal in real estate. This guidebook is here to help you create a successful multifamily project. It covers everything you need to know, from the basics of what goes into building apartment buildings, to how to plan multifamily projects, spot market trends, and handle the construction and management of these buildings. If you’re an experienced multifamily developer or just starting out, this guide will help you understand what makes multifamily projects successful and what new trends are shaping city living.

What is a multifamily development?

Multifamily development is when you build buildings that have several separate living spaces inside them. Instead of just one house, a multifamily building might have apartments or condos where different families or people can live in their own private areas but all within the same building or complex.

Multifamily development helps use land more effectively and lowers the cost per apartment or unit. This setup can bring in steady rental income from several tenants instead of just one, which helps meet the increasing need for housing in cities. It can also lead to better investment returns and makes it easier to include amenities like gyms or pools for the residents.

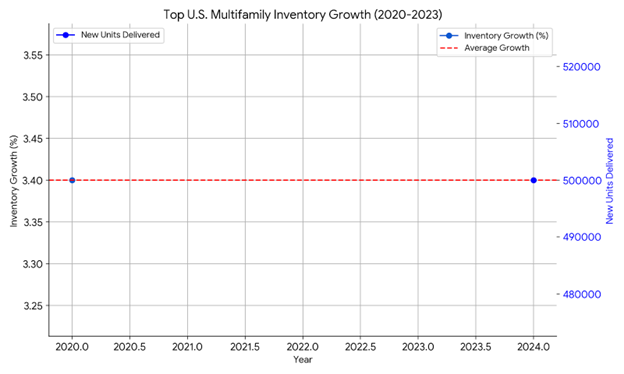

In major U.S. cities, there have been more apartments to rent in recent years, growing at about 3.4% each year since 2020. This year, 2024, is set to have the most new apartments ever, with almost half a million being finished. Even though rent prices haven’t increased much overall, more people are moving into these new apartments now than they have since 2021.

It is a vital sector that provides housing for millions of Americans across the country. In major U.S. cities, there have been more apartments available for rent in recent years. This growth has been steady, averaging around 3.4% each year since 2020.

Importance of strategic planning in multifamily development

Strategic planning is really important for multifamily development because it helps ensure the project is successful and handles the various challenges that come up. Here’s why it’s so important:

- Market Analysis and Demand Assessment: This involves studying the local market to understand what types of housing people need and want. Developers also look at what other projects are coming up to find out where the project might fit in and spot any gaps in the market.

- Feasibility Studies: Before moving forward, developers need to make sure the project is financially viable. This means calculating how much it will cost, how much money it could make, and how to handle risks like economic changes or construction issues.

- Site Selection and Acquisition: Choosing the right location is key. The site should be easily accessible and appealing to the target market. Developers also need to ensure the site meets local zoning laws and building codes.

- Design and Development: This phase involves planning the layout, appearance, and features of the building. It’s important to include amenities that people will want and to use sustainable, energy-efficient designs to keep costs down and attract tenants.

- Financing and Budgeting: Developers need a solid financial plan, including how you’ll fund the project and manage the budget to avoid overspending. You should also create financial projections to guide your investment decisions.

- Marketing and Leasing Strategy: Developers need to figure out who the target tenants are and how to attract them. This includes setting rental prices, running promotions, and creating incentives for tenants.

- Regulatory Compliance: Throughout the project, developers must get the necessary permits and follow all local, state, and federal regulations. They also need to stay ahead of any potential legal issues.

- Project Management and Execution: This involves setting a timeline with key milestones to keep the project on track and ensuring construction meets quality standards.

- Operational Planning: Once the building is finished, developers need a plan for managing the property, including maintenance and upgrades to keep it in good shape and competitive.

- Exit Strategy: Finally, developers plan how they will sell or refinance the property to get the best return on investment, based on current market conditions.

Strategic planning helps developers manage every part of the project effectively, from start to finish, minimizing risks and making sure the project meets market needs and regulatory standards.

Key opportunities in multifamily development

Opportunities in multifamily development are varied and can be very rewarding. Here’s a look at some of the key opportunities:

- Urban Growth and Changing Preferences: As cities expand, more people, especially younger generations, are looking for rental apartments. This increases demand for multifamily housing.

- Government and Community Support: There are often government incentives, like tax breaks, for building affordable housing. Plus, building affordable units can also win community support, which is helpful for a project’s success.

- Luxury Markets: Developing high-end apartments with fancy amenities, like gyms and rooftop lounges, can attract wealthier tenants and allow for higher rents.

Overall, these opportunities help developers create successful projects that meet current housing demands and offer good financial returns.

Types of multifamily Development

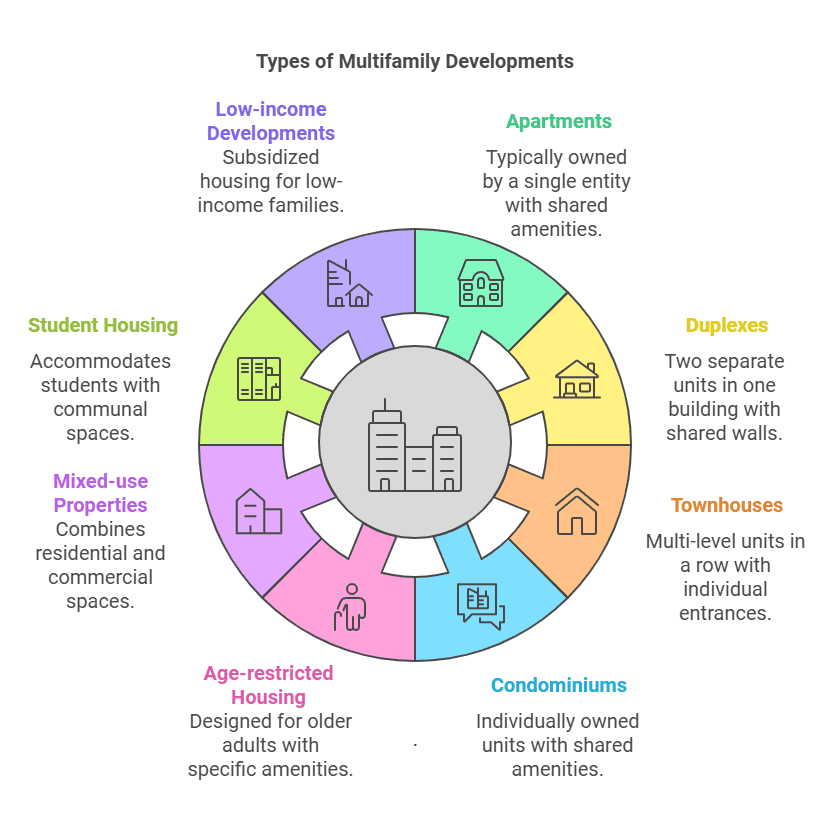

Apartments

Apartments are a common option for people who want to live in a multifamily setting. Instead of buying a place, you rent an individual unit from a property management company or a real estate investment trust (REIT). In an apartment building, the owner takes care of maintenance and management, while renters just enjoy their living space. Apartments often have shared amenities like swimming pools, gyms, and playgrounds.

The key thing about apartments is that a single entity owns the whole building, and the individual units are rented out to different people. They can range from basic to luxurious, with some offering upscale features like community pools, theaters, and game rooms.

High-Rise Apartments

High-rise apartments are tall buildings designed to fit more people into a smaller area. They are usually over twelve stories high, and some can have fifty floors or more. These buildings often have fancy features and offer amazing city views.

Even though they are very tall, high-rises often include green spaces like rooftop gardens and balconies to keep things fresh and pleasant. The design of these buildings can vary, from single tall towers to several towers connected together, all aimed at maximizing light and city views.

Low-Rise Apartments

Low-rise apartments are shorter buildings, typically 3 to 6 stories high, and are common in urban areas. They offer medium-density living and often create a close-knit community feel among residents.

Low-rise buildings usually have between six and forty units and often include communal spaces like playgrounds, laundry facilities, and picnic areas. They can vary in price and amenities, from affordable to more upscale options, depending on the building and its location.

Townhouse

Townhouses are a popular type of home that combines the features of both apartments and single-family houses. They usually have multiple floors and share walls with the homes next to them. Townhouses are often built in rows or clusters, which helps create a close-knit community feeling. Each townhouse has its own entrance and may include a small private patio or garden. Residents typically have access to shared amenities like a pool or community garden. In busy city areas, townhouses make efficient use of space by fitting several homes on a single street. In suburbs, they help create well-planned neighborhoods with shared spaces like parks, courtyards, and clubhouses.

Townhouses can be either rented or purchased. The common areas, like parks or community gardens, are usually maintained by a homeowners’ association (HOA), which is a group of residents who manage these shared spaces. Even though each townhouse is individually owned, they are part of a larger multifamily property. They are often more affordable than single-family homes, making them a popular choice for both buyers and investors.

Townhouse neighborhoods often have a quiet, gated atmosphere, making them appealing both in upscale urban areas and in well-planned suburban communities.

Duplex

A duplex is a type of building that contains two separate living units. Each unit has its own entrance and often shares a wall with the other unit. To keep things private, the entrances are usually on opposite sides of the building.

Duplexes can be rented or purchased. The owner is responsible for taking care of the building, including repairs and maintenance. They provide two distinct living spaces in one structure, which makes them a practical choice for people interested in living in or investing in multifamily properties.

Condominiums

Condominiums are a type of multifamily housing where each unit is owned by a different person. Condos can be part of a big building or even stand-alone units like small houses.

The owner of the condo is responsible for maintaining the interior of your condo. However, common areas, like swimming pools, gyms, parking lots, and gardens, are shared with other condo owners. These shared spaces are managed by a homeowners’ association (HOA), which collects monthly fees from condo owners to take care of maintenance and sometimes insurance for the building.

Condos are often designed with specific lifestyles in mind, making them appealing to busy professionals or retirees who want convenience and lower maintenance. They offer the benefits of owning a home, like building equity, while also providing shared amenities and less upkeep. This makes condos a popular choice for first-time buyers and investors.

Mixed-Use Developments

Mixed-use developments are buildings or communities that combine living spaces with commercial areas. In these developments, residential units are usually on the higher floors, while the ground floors are occupied by businesses like stores, eateries, or offices.

The idea behind mixed-use developments is to create lively, convenient communities where you can live, work, and play all in one place. This setup cuts down on long commutes and makes daily life more enjoyable, as everything you need is right nearby. Mixed-use properties are often managed by real estate companies or investment trusts. Besides homes and shops, these developments might also include cultural venues, offices, and public transportation options, making them even more convenient.

In busy city areas, mixed-use developments are a popular way to blend residential living with commercial and cultural activities, creating vibrant and well-rounded communities.

REGULATORY & LEGAL CONSIDERATIONS FOR MULTIFAMILY DEVELEOPERS

Multifamily developers must comply with a host of regulations governing all aspects of the development process:

Zoning and Land Use

When developers are buying and developing land, the first thing to check is zoning and land use rules. Zoning laws tell you what you can and can’t do with the land, like whether you can build apartments, shops, or something else. It’s important to understand these rules before you start your project. If the land’s current zoning doesn’t fit the developer’s plans, they might have to apply to change it, which can be a tricky process and isn’t always approved.

Besides zoning, developers also need to consider other restrictions, such as building codes, environmental regulations, and any rules about preserving historical sites. These can affect how you plan and build your project.

Buying land involves more than just paying for it. Developers need to research zoning laws, environmental issues, any easements (rights of way) on the property, and any title problems. Understanding these rules and getting the necessary permits is essential to follow local regulations. Planning around zoning and other restrictions takes time and careful thought. Working with local authorities and getting all the permits in order can help avoid delays and make the development process smoother.

Contracts and Agreements

Real estate development involves lots of deals between different people and groups, like investors and contractors. You’ll deal with different types of contracts, such as:

- Purchase Agreements: For buying land.

- Construction Contracts: For hiring general contractors to actually construct the property.

- Financing Agreements: For getting the money needed to fund the project.

- Lease Agreements: For renting out spaces in the property once it’s built.

Development Strategy

Let’s take a look at a few of the essential things in the development strategy.

DEFINING PROJECT GOALS & OBJECTIVES

Understanding the purpose of your real estate project is crucial for its success. If you’re working on rental properties, your main goal is to generate consistent income. To do this, keep your units occupied, manage expenses carefully, and ensure the property stays attractive. Effective property management and setting competitive rental rates are important.

For condominiums developers plan to sell, focus on creating appealing units that will attract buyers quickly. Price them well and include desirable features to make them stand out. Good marketing is key to reaching potential buyers. It’s also important to understand who your target market is. Luxury renters look for high-end amenities and premium spaces. Working professionals need convenience and affordability. Seniors require accessible living spaces with specialized services. Students prefer properties near universities with features suited to student life. Affordable housing should be budget-friendly and blend well with the community.

To measure your success, keep track of factors like occupancy rates, rental income, and return on investment (ROI). Evaluate how well the property is managed, tenant satisfaction, and how it fits in the market. Plan strategically by aligning your design and development with your market needs. Use targeted marketing and financial planning to meet your goals. Regularly review your progress and be ready to make changes based on performance and feedback to stay on track.

MARKET POSITIONING & TARGET DEMOGRAPHICS

Understanding who you’re building for and what kind of place you want your property to be is really important. This helps developers decide on things like what features to include, how much to charge, and how to market your property.

To figure this out, developers can use data from sources like the US Census Bureau and studies that look at things like supply and demand, what similar properties offer, and what renters or buyers want.

PRODUCT DESIGN & AMENITY PLANNING

Smart developers handle multifamily projects by paying close attention to every detail to make the place both welcoming and practical. You can start with designing a great entrance, adding nice landscaping and an attractive building look to make a strong first impression.

The building’s outside design is made to fit in with the neighborhood and reflect the high quality of life they want to offer. Inside, developers add features that help residents connect and enjoy their living space, like stylish rooftop lounges or fun playgrounds.

They also include modern technology, like smart thermostats and automated lighting, to make life easier and save energy. For pet owners, amenities like dog parks are included.

Safety is a top priority, with high-quality security systems and good emergency plans. Developers also offer customization options so residents can personalize their homes, and they ensure accessibility with ramps and elevators for everyone to use easily.

FINANCIAL FEASIBILITY ANALYSIS

Before buying land or securing financing for a project, developers create a detailed financial plan called a proforma. This plan helps them figure out if the project will be profitable. Here’s what they need to think about:

Development Costs and Budgeting:

Developers must estimate all costs involved in the project. This includes:

Land Costs: The price of the land itself.

Construction Costs: Expenses for building the project.

Professional Services: Fees for architects, engineers, and other experts.

Marketing and Leasing Costs: Money spent on advertising and finding tenants.

Financing Costs: Interest and fees for loans.

Operating Deficits: Costs needed to run the property until it starts making enough money.

Financing Options and Sources:

Developers look at different ways to get the money needed for the project. They might use:

- Equity: Money invested by individuals or companies.

- Loans: Traditional bank loans.

- Bonds: Government or corporate bonds.

- Tax Credits: Special tax breaks.

- Government Programs: Funds from various government initiatives.

- EB-5 Investment: Investments from foreign investors seeking U.S. visas.

They choose the best mix of these options based on costs, how much investment is needed, and how they plan to exit the investment.

Proforma Analysis and Investment Returns:

The proforma calculates future cash flows from the project, such as:

- Rental Income: Money earned from renting out the property.

- Sale Proceeds: Money from selling condos.

- Operating Expenses: Costs to run the property.

- Debt Service: Payments for loans.

- Taxes: Government taxes.

The proforma calculates future cash flows from the project, such as:

- Rental Income: Money earned from renting out the property.

- Sale Proceeds: Money from selling condos.

- Operating Expenses: Costs to run the property.

- Debt Service: Payments for loans.

- Taxes: Government taxes.

Developers use metrics like cash-on-cash returns, internal rates of return, and capitalization rates, as outlined by prominent real estate authorities like Russell and Dawson to assess if the projected returns meet their goals and if there are any risks. These metrics help them determine if the project is a good investment.

SITE ACQUISITION

Finding and securing the right site for a multifamily project is crucial. Here’s how the site acquisition for multifamily development goes:

First, developers need to evaluate potential sites based on several factors, such as how close the site is to important places (like schools or shops), how accessible it is, its size and shape, local zoning laws, how visible it is, and any environmental issues. An extensive due diligence process examines all aspects including assessing the land’s physical features, verifying ownership, ensuring utilities like water and electricity are available, and making sure the site meets local regulations. This process is crucial because problems like contamination or zoning issues can ruin a deal.

Once a site looks good, you can start negotiating the purchase terms. They discuss things like the price, how long the purchase process will take, and any conditions that must be met before finalizing the deal. Having financing lined up can help with these negotiations.

If the negotiations go well, the final steps involve completing legal paperwork, conducting final surveys, and preparing for the closing of the deal. This includes making sure all conditions are met and setting up the purchase in a way that’s beneficial for taxes and liability.

Overall, acquiring the right site involves careful planning and thorough checks to ensure it will work well for the planned development.

PROJECT TEAM & PARTNERSHIPS

Developing a multifamily project is complex, so developers need a skilled team of experts to help.

First, developers put together a team, starting with an architect. The architect’s job is to take the developer’s ideas and turn them into detailed plans that can actually be built. It’s important to hire an architect who has experience with multifamily projects and a strong portfolio.

Once the design is ready, the general contractor and their construction team come in to build it. Good contractors are familiar with modern construction techniques and materials, so choosing the right one is crucial. Developers usually go through a bidding process to find the best contractor.

In addition to architects and contractors, developers work with other specialists, such as civil engineers (who focus on the land and infrastructure), structural engineers (who ensure the building’s structure is safe), landscape architects (who design outdoor spaces), and interior designers (who design the inside spaces). They might also need experts for traffic studies, legal advice, and accounting.

Clear contracts are important for outlining what each team member is responsible for, what they need to deliver, and how they will be held accountable. Regular meetings help everyone stay on the same page throughout the design and construction phases.

DESIGN & PLANNING

In the design phase, the developer’s vision for a project is turned into actual plans and spaces. For multifamily projects, this means creating places where people can live, like apartments, townhomes, and condos.

Architectural Design and Space Programming

Architects work with developers to decide how to use the space. They plan out where things like amenities, apartments, parking, and pathways will go. The goal is to make the space work well for the people who will live there. For high-end renters, the design might include fancy finishes and stylish layouts. For others, the focus might be on practical features and smart use of space.

Site Planning and Engineering

The site plan shows where the buildings will be placed and how things like traffic flow, utilities, landscaping, and recreational areas will be arranged. Civil engineers make sure that the plans meet regulations and are built according to best practices.

Sustainable Design and Green Building Practices

Designing with sustainability in mind helps save energy and attract eco-conscious renters. This includes using energy-efficient lighting, green roofing, and other environmentally friendly practices to make the building more efficient and appealing.

CONSTRUCTION & PROJECT MANAGEMENT

Once a plan is ready and permits are approved, developers of apartment buildings team up with general contractors to start the construction. They need to get materials, make detailed schedules, organize inspections, and manage the daily work to turn blueprints into real buildings.

Construction Planning and Scheduling

A clear schedule and budget are made based on the contractor’s estimates, which outline what needs to be done and how much it will cost at each stage. The contractor’s superintendents handle coordinating all the subcontractors (like electricians and plumbers), manage material deliveries, and ensure everything meets quality standards at every step.

Cost Control and Risk Management

Developers and contractors keep a close eye on the budget and any changes that might come up. They use standard contracts like AIA (American Institute of Architects) contracts to help handle any unexpected issues. You will also have regular on-site meetings and check-ups to ensure that the project stays on track and meets quality standards.

Quality Control and Inspections

Construction projects often face challenges like bad weather or material shortages. To deal with these issues, developers have backup plans in place. You also make sure the building follows US building codes like those established by the International Code Council (ICC), by conducting regular inspections. Additionally, developers prepare for people to move in by coordinating marketing efforts, setting up technology systems, and finalizing services for new residents.

With planning and permitting complete, multifamily developers partner with general contractors to procure materials, create detailed construction schedules, secure necessary inspections, and oversee the daily tasks of transforming building plans into real properties.

LEASE-UP & STABILIZATION

Once the construction of a new apartment building is finished, the real challenge starts: filling up the apartments and making sure they stay occupied. This process is called “leasing up” and “stabilization.”

Marketing and Leasing Strategies

Before the apartments are officially open, developers start promoting them. They might use a website, create advertisements, set up special waiting lists, and reach out to potential renters to build interest. When people come to check out the apartments, leasing specialists give tours, help with applications, and guide new renters through the move-in process.

Developers also offer appealing features like innovative amenities, modern community spaces, and smart home technology to make the apartments more attractive. They aim to create a welcoming environment that makes residents feel at home and happy.

Resident Retention and Customer Service

To keep residents happy and make sure they stick around, you should focus on great customer service. This includes having a responsive management team, 24/7 maintenance, community events, and well-maintained amenities. They follow best practices recommended by organizations like National Apartment Association (NAA) to ensure a high-quality living experience.

Property Management and Operations

The property owner or developer manages everything about the apartment building. This includes making sure rules are followed, handling leases, collecting rent, paying bills, managing repairs, and keeping track of finances. They also use smart technology to improve efficiency and keep in touch with tenants.

This process helps you ensure that once the building is completed, it’s quickly filled with happy residents and runs smoothly.

With construction complete, the real work begins for multifamily developers – quickly leasing up the property to stabilized occupancy. A comprehensive marketing and leasing strategy is key to driving prospects and conversions.

ASSET MANAGEMENT & DISPOSITION

After a new apartment building is filled and running smoothly, the next big job is to keep it valuable and profitable. Here’s how the process of asset management and disposition is done:

Managing the Property

Even after the apartments are stabilized, developers keep working to make sure they’re performing well. They track important things like rental prices, how many units are occupied, how often people move in or out, any discounts given, late rent payments, and how operating costs match up with their budget.

Improving the Property

To make the apartments more valuable over time, developers might upgrade the units and common areas. For older buildings, they might do big renovations or change the property to attract more tenants or increase its value.

Value-Add Strategies

Developers also look for ways to make the property more appealing and efficient. This might include making the building more eco-friendly, which can lower utility bills and attract renters who care about sustainability. They might also use profits to add new features or improve common areas, making the living experience even better.

Exit strategies and investment returns

Eventually, you need to decide what to do with the property. You, as a developer can:

- Sell it to make a profit

- Refinance (get a new loan) to get some money out of it

- Invest more money into renovating or improving it for future gains

Developers make these decisions based on market conditions, how well the property is performing, and tax benefits. The goal is to make the most money from their investment while continuing to provide a great living experience for tenants.

In short, effective management and smart investments can help you maximize the value of your property and get the best return on their investment.

Final thoughts

The process of developing apartment buildings is a long and complex journey. It involves careful planning, attention to detail, and teamwork to get everything right. Here’s a summary of what we’ve covered:

- Understanding the Market: Knowing what people want and need in rental housing.

- Researching Sites: Checking out potential locations and deals thoroughly.

- Planning Your Approach: Deciding how to design the building and who the target renters will be.

- Budgeting and Financial Planning: Calculating the costs and potential returns on investment.

- Building the Right Team: Bringing together skilled professionals and partners.

- Managing Construction: Overseeing the design, planning, and building process.

- Marketing and Managing: Attracting renters and keeping the property in good shape.

- Increasing Property Value: Making improvements and planning for selling or refinancing.

Even though it’s challenging, there are prodigious opportunities in the multifamily development field for those who are willing to put in the effort and learn the ropes.

Looking ahead, the demand for rental housing is expected to grow due to major demographic changes. For example, as millennials reach their prime renting years and baby boomers look to downsize, there will be more need for quality rental properties. According to a report from Dodge Construction Network, the value of new commercial and apartment building projects in the top 10 US cities went up by 37% in 2022 compared to 2021. Overall, across the country, new construction for commercial and apartment buildings also increased by 25%. This rise in construction shows that there’s a growing demand for good-quality apartment buildings to meet changing population needs.

Residents’ preferences are changing too. People now want better amenities, smart technology, eco-friendly features, and a strong sense of community. Developers who keep up with these trends will be able to charge higher rents and make better returns on their investments.

New construction methods and technologies, like modular building and virtual leasing, are also shaping the future of apartment development. If you’re thinking about getting into this field, or if you’re an experienced developer looking to move forward, it’s important to do thorough research, plan carefully, and take calculated risks. Having a great team, staying hands-on with management, and staying alert for new opportunities will help you succeed.